how to calculate cash assets

They are considered to be the most liquid assets that a company owns. You can follow these steps to measure a companys non-cash working capital using its current assets.

Total Assets Formula How To Calculate Total Assets With Examples

Depreciation allows a business to deduct the cost of an asset over time rather than all at once.

. Now if the company had 10000 in cash and other liquid assets worth 15000 that it could sell in a few days for cash it would be able to. Level 2 includes observable inputs such as quoted prices for similar assets. Your assets are anything that you own including the cash you have on hand.

Lets be honest - sometimes the best debt to assets ratio calculator is the one that is easy to use and doesnt require us to even know what the debt to assets ratio formula is in the first place. Straight-line depreciation is the usual method used to calculate amortization. Positive cash flow indicates that a companys liquid assets are increasing enabling it.

Intangible assets include proprietary software contracts and franchise agreements. We need our total PL income statement operating expenses excluding depreciation and amortization and our current cash balance. This hierarchy has three levels.

Assets usually divided into current assets and fixed assets Your current assets include the cash you have on hand and what could be liquidated quickly usually within a. However the family wants to sell the company so they can retire. To calculate working capital subtract a companys current liabilities from its current assets.

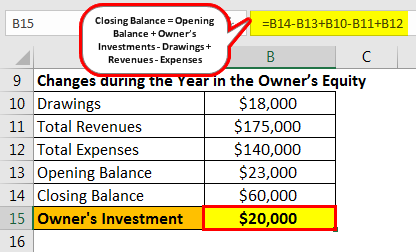

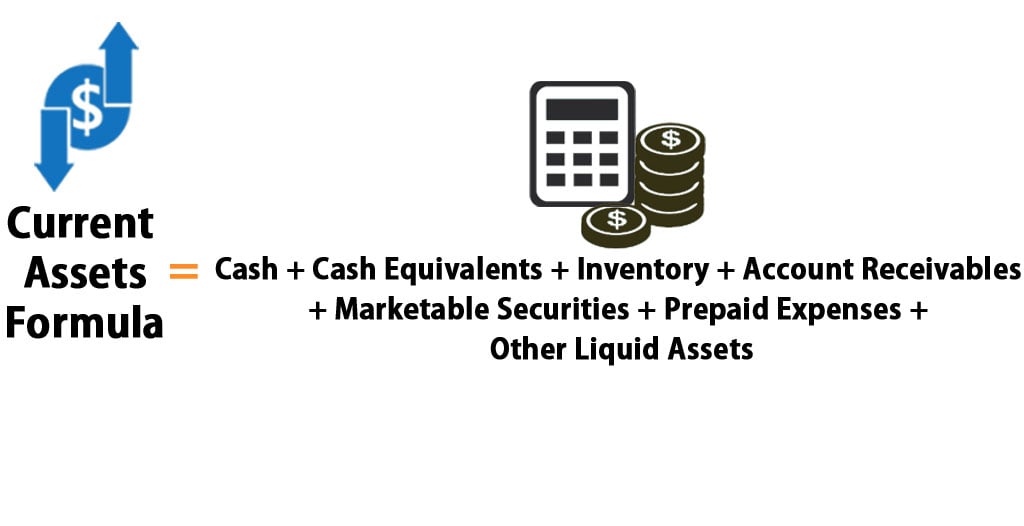

It comprises inventory cash cash equivalents marketable securities accounts receivable etc. To calculate retained earnings subtract a companys liabilities from its assets to get your stockholder equity then find the common stock line item in your balance sheet and take the total stockholder equity and subtract the common stock line item figure if the only two items in your stockholder equity are common stock and retained earnings. To help you see current market conditions and find a local lender current Redmond mortgage refinance rates are published in a table below the calculator.

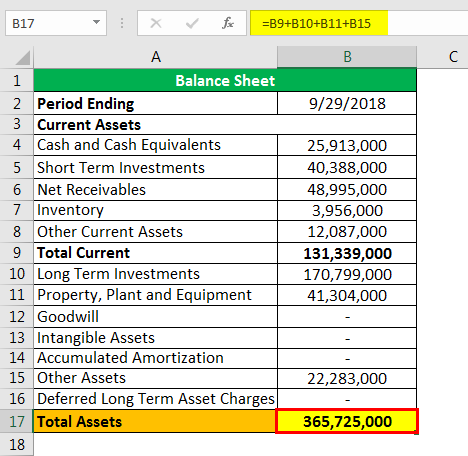

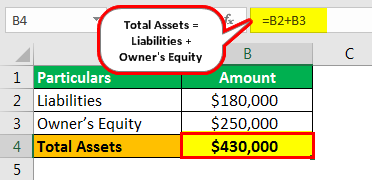

The most common way to calculate operating cash flow is through the indirect method which takes into account the net income under an accrual basis of accounting. To calculate your businesss total assets you first need to know what assets you have. A liquid asset is an asset that can be converted into cash quickly with minimal impact to the price received in the open market.

How to Calculate Debt to Assets Ratio. Cash flow is the net amount of cash and cash-equivalents moving into and out of a business. Interest Paid on Idle Cash Balances 3.

A potential buyer wants to know Johnson Paper Companys cash flow assets from the past. The income approach reflects future cash flow income and expenses related to the asset. The current assets of XYZ Limited for the year ended on March 31 20XX is 191000.

Cash Out Mortgage Refinancing Calculator. Example of calculating cash flow from assets. Fraudsters are continuously coming up with new financial scams to defraud consumers and take their money.

Let us take the example of Walmart Incs annual report for the fiscal year Fiscal Year Fiscal Year FY is referred to as a period lasting for twelve months and is used for budgeting account keeping and all the other financial reporting for industries. Operating Cash Flow OCF is the amount of cash generated by the regular operating activities of a business in a specific time period. To calculate a companys current assets you can use the following formula.

Read more are those assets that are expected to be converted into. The term is also used to refer to assets that are already in cash form. Calculate your current assets.

The main assets that fall under the quick assets category include cash cash equivalents accounts receivable and marketable securities. Read more minus capital expenditure Capital Expenditure Capex or Capital Expenditure is the expense of the companys total purchases of assets during a given period determined by adding the net. It really boils down to managing our accounts receivable and accounts.

A positive amount of working capital means a. Begins at Benchmark plus 15 with lower rates for higher loan values. Change in working capital operating assets and liabilities adjustments include.

In some cases the accounts on the balance sheet -- assets liabilities and equity -- can also shed light into items that would normally be. Working capital is difference between our current assets and our current liabilities. 5 of this section regarding shared expenses.

Start by listing the value of any current assets assets that can easily be converted to cash like cash money owed to you and inventory. Current Assets Current Assets Current assets refer to those short-term assets which can be efficiently utilized for business operations sold for immediate cash or liquidated within a year. Interest Charged for Margin Loan.

Depreciation accounts for decreases in the value of a companys assets over time. Whether youre an accountant a financial analyst or a private investor its important to know how to calculate how. To calculate gross cash burn we require two inputs.

Liquid assets include money market instruments and. Current assets cash cash equivalents inventory accounts receivable marketable securities prepaid expenses other liquid assets. Intangible assets are assets that dont have a physical form.

Everyone should be able to recognize the red flags of a scammer and know the best steps to take to protect themselves such as never giving out. The IRS requires you to amortize intangible assets over 15 years or 180 months. Here are some examples of how to calculate cash flow from assets.

Assets are any resources of financial value to a business. Johnson Paper Company is a family company that sells office supplies. But if you want to know the exact formula for calculating debt to assets ratio then please check out the.

Compute the RCP based on the taxpayers separate income household expenses they are required to pay individually owned assets and jointly held assets using the allocations described in IRM 5855 Jointly Held Assets taking into consideration community property laws if applicable. On the asset side of a. Companies use quick assets to compute certain financial ratios.

Current Assets Formula Example 2. Level 1 includes quoted prices for identical assets in active markets. You can change the loan term or any of the other inputs and results will automatically calculate.

Determine your assets. The first calculator figures monthly home payments for 30-year loan terms. Net income factors in current assets accounts receivable inventory etc and current liabilities such as accounts payable whereas cash flow does not.

Operating Activities includes cash received from Sales cash expenses paid for direct costs as well as payment is done for funding working capital. US Retail Investors 5. GAAP defines a hierarchy of sources of information for valuing the asset.

/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-01-43bbd8c00ab24868899a202af2f7ba30.jpg)

How To Calculate Return On Assets Roa With Examples

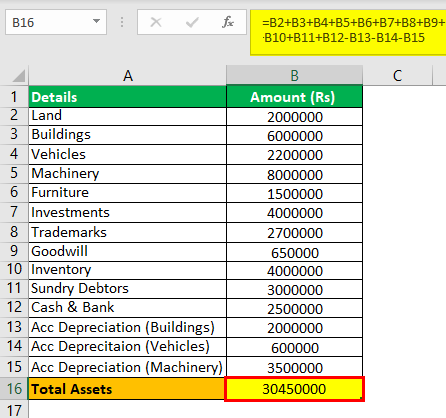

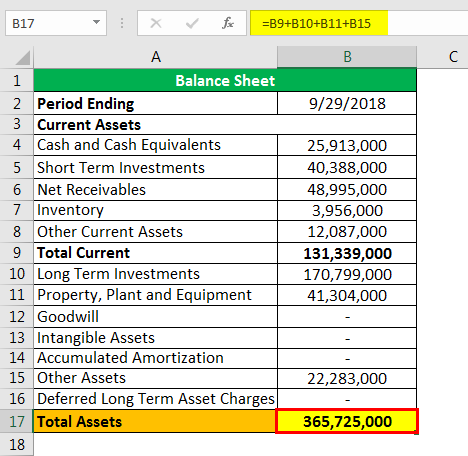

Total Assets Formula How To Calculate Total Assets With Examples

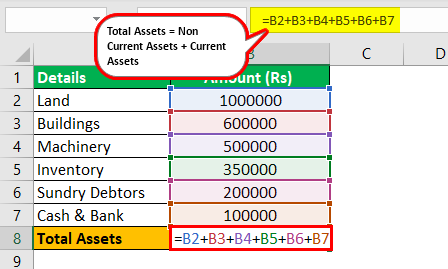

How To Calculate Total Assets Definition Examples

/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-01-43bbd8c00ab24868899a202af2f7ba30.jpg)

How To Calculate Return On Assets Roa With Examples

Current Assets Formula Calculator Excel Template

Net Worth Calculator Find Your Net Worth Nerdwallet

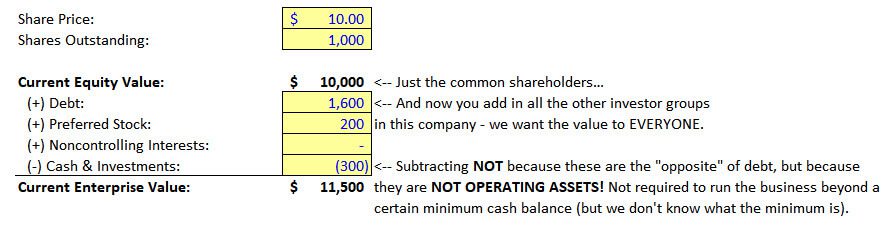

How To Calculate Enterprise Value 3 Excel Examples Video

Total Assets Definition Example Applications Of Total Assets

Total Assets Definition Example Applications Of Total Assets

Cash Flow Formula How To Calculate Cash Flow With Examples

Total Assets Definition Example Applications Of Total Assets

Total Assets Definition Example Applications Of Total Assets

Current Assets Formula Calculator Excel Template

Total Assets Formula Formula Calculation Explanation

How To Calculate Total Assets Definition Examples

:max_bytes(150000):strip_icc()/ScreenShot2022-04-07at10.21.44AM-4b083a721f744f4ebb05c3a418c382d2.png)

Current Assets Vs Noncurrent Assets What S The Difference

Total Assets Formula How To Calculate Total Assets With Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Other_Current_Assets_OCA_Dec_2020-01-1ef8bd75eff345e7ac48ba70fb718619.jpg)

/dotdash_Final_Other_Current_Assets_OCA_Dec_2020-01-1ef8bd75eff345e7ac48ba70fb718619.jpg)